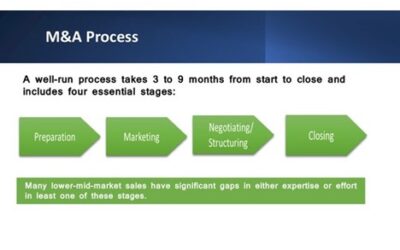

In order to ensure that your mergers and acquisition (M&A) transaction is successful, it’s essential to partner with an experienced M&A advisory firm. Here are three tips for choosing the best M&A firm for your business.

- Understand What M&A Advisory Firms Do

- If you are looking to sell, your investment banker should

- Be knowledgeable about your industry

- Help you set value expectations

- Help you plan your timing

- Craft “go to market” strategies

- Work with you to form a compelling investment thesis and assembling marketing materials such as the “Confidential Information Memorandum” to communicate your information.

- Identify and contact potential investors or buyers,

- Coordinate the buyer due diligence and information flow

- Set up and manage on online “Virtual data room.”

- Coordinate and review the solicitation of bids and help you negotiate and select a winning bidder.

- Work with your attorney to help you negotiate the best deal terms.

Not all M&A firms are created equal. Typically, M&A (investment bank) advisory firms specialize in certain industries or firm size. You will want to choose a firm that is accustomed to working with your size enterprise and has the resources to supplement the gaps in your internal capabilities. Terms you might hear are lower middle market, middle market large cap firms. Business Brokers will typically advise smaller firms while Investment Bankers deal with Lower Middle Market, Middle Market, Large Cap and publicly traded firms. Be sure to research each firm thoroughly before engaging them in any negotiations.

- Look at the Track Record of M&A advisory firms

You should also take a look at the track record of any potential M&A advisory firms you’re considering working with. Look into their past deals and see how successful they have been in guiding companies through the process from start to finish. It’s also a good idea to speak with other businesses that have worked with the same firm to get an idea of their experience working together, so you can make an informed decision about who you want to partner with for your own deal.

- Use Axial to Help Choose an M&A Advisory Firm

Axial is a leading online network providing unique, powerful tools to help users find and connect with the right partners. With access to a large network of investment bankers and corporate executives, Axial makes it easier than ever to identify potential advisers and match you with advisers that fit your needs. partners. Thanks to its sophisticated search capabilities and predictive analytics, Axial can quickly hone in on the right firms for any given project – giving users the best chance at success.

In 2021 and 2022, The Peakstone Group WAS ranked the #1 Investment Bank serving Lower Middle Market and Middle Market firms. Sandhill Consulting Group has consulted to a number of firms to help them improve their business and operations, and prepare them to work with the Peakstone Group to make an acquisition or sell their business.

Sandhill Consulting Group is a leading consulting firm that has extensive experience in helping clients navigate complex issues from start to finish, including due diligence and post-merger integration planning and execution.

Choosing the right consulting firm to prepare your business is an important first step in choosing the right M&A advisory firm. The right advisors are key if you want to maximize value and for your transaction to be handled properly and efficiently from start to finish. By taking time upfront to research potential partners and by using Axial, you can improve your odds of finding the right transaction partner.

If you are looking for an experienced team with global reach and local market knowledge to help you craft strategy, improve operations and prepare yourself to hire an Investment Baner for a transaction, Sandhill Consulting Group is an excellent choice that has helped many companies successfully navigate complex opportunities. Contact Sandhill to learn more details.